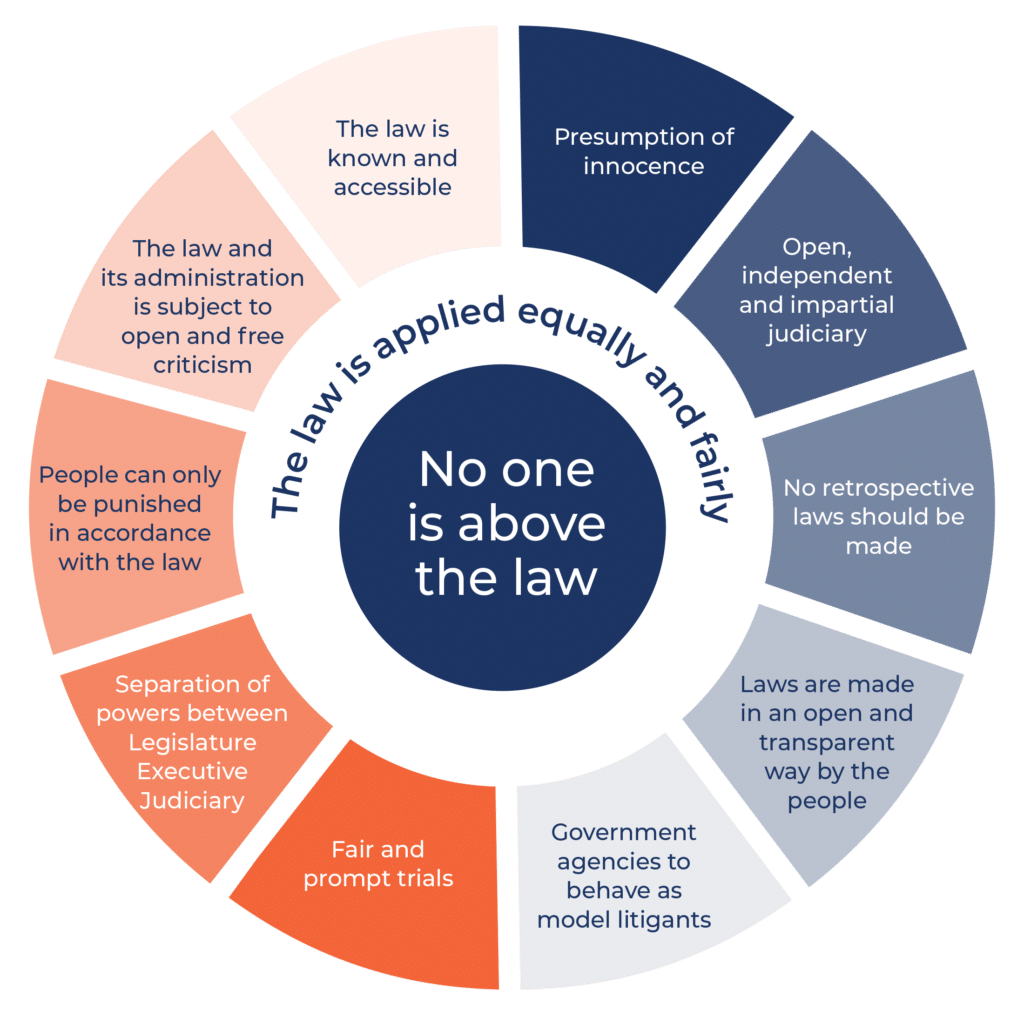

The Institute has lodged a submission regarding proposed extra powers to be given to the Commissioner of Taxation, noting the importance of the equal application of the law, and for transparency and accountability around the exercise of power.

The submission follows the Federal Government’s announcement in May last year that they were planning to give the Commissioner of Taxation the power to modify the operation of tax and superannuation laws in certain circumstances.

The Commissioner’s “Remedial Power” is intended to operate where laws give rise to unforeseen or unintended consequences, and to allow the Commissioner to fast-track minor amendments to those laws, consistent with their purpose or object.

In December last year, the Treasury released an Exposure Draft of a legislative amendment to the Taxation Administration Act 1953 (Cth), setting out the legislative basis for the planned Remedial Power.

After reviewing the Exposure Draft and the accompanying explanatory material, the Institute drafted a submission noting the many safeguards built into the legislation to protect the rule of law.

However, we also noted that there remained concerns about the Remedial Power’s possible unequal application, and the lack of mechanisms for ensuring transparency and accountability around its use in the future.

Read our full submission on the Remedial Power

The deadline for submissions is Friday, 15 January 2016. Information regarding the call for submissions can be found on the Treasury’s website.